How do I buy a new condo under $250k in Mexico using a Mexican mortgage loan?

There are a few drawbacks to buying an amazing and new condo in Mexico with mortgage that you do not know until you begin to look into what it would take to buy a condo in Mexico using a mortgage loan. The bottom-line is that while there are not many options available there a are a few options worth exploring.

In this article I have focused only on who, from our financing page, can help get a loan for a pre-construction property worth the equivalent of $218,000 USD.

The first mayor drawback is the price. Many mortgage or private lenders in Mexico have a minimum limit. For example, MOXI (not included in my financing page) has a minimum loan amount of 350k USD. This is what they say via email regarding a loan of under $350,000 USD:

Hola,

Thank you for inquiring about MoXi’s financing options. We weren’t able to match you with a financing program at this time, but we do hope you’ll keep in touch if anything should change – and we will keep you updated if any of the qualifying items below should change.

Currently, MoXi only issues loans for:

✔ US Citizens or permanent residents

✔ Properties with a MINIMUM value of $350,000 USD (loans $250,000 USD – $2.5M USD)

✔ Transactions within 12 months

✔ Max 65% LTV with good credit

If you DO meet these criteria, please reply to this email and we will get everything sorted out!

With Gratitude,Team MoXi

No loans of amounts under $350,000 USD are available with MOXI also known as Global Mortgage.

This is what Intercam Bank says regarding a 65% Loan to Value:

TERMS

‣Currency: USD

‣Fixed rate

‣Nationality: USA or Canadian citizens

‣Min. property value: $250,000 USD

‣Loan-to-value: up to 65% of the appraisal value

‣Loan length: 5 to 25 years

‣Min. FICO: 700

‣Benefits: no prepayment penalty, interest is calculated on the unpaid balance, a One-stop banking experience.

No loans of amounts under $250,000 USD are available with Intercam Bank. And no loans for Pre-constructions projects. See their Dream-loan program here.

This is what Cross Border Investment (CBI) says regarding a 65% Loan to Value:

We do offer USD mortgages with a 65% loan-to-value ratio (LTV). However, the minimum loan amount required to qualify for these options typically ranges from $162,000 to $250,000 USD.

CBI does offer loans for properties valued at under $250,000 USD However, the LTV ratio must be 60% of the property. That means that you must have 40% of that loan upfront and cover all closing costs & fees of about $28,000 USD. That means that you still would need about $128,000 USD upfront for a loan of $250,000 USD. This would leave you with a decent monthly payment of about $1,450 USD if you have decent credit score using CBI. This a nice option available but, you would need to save have close to 50% of total value of the property. Find Karina in our financing page if you are interested.

How about a loan in Mexican Pesos for an amount equal to $218,000 USD?

There a few options available:

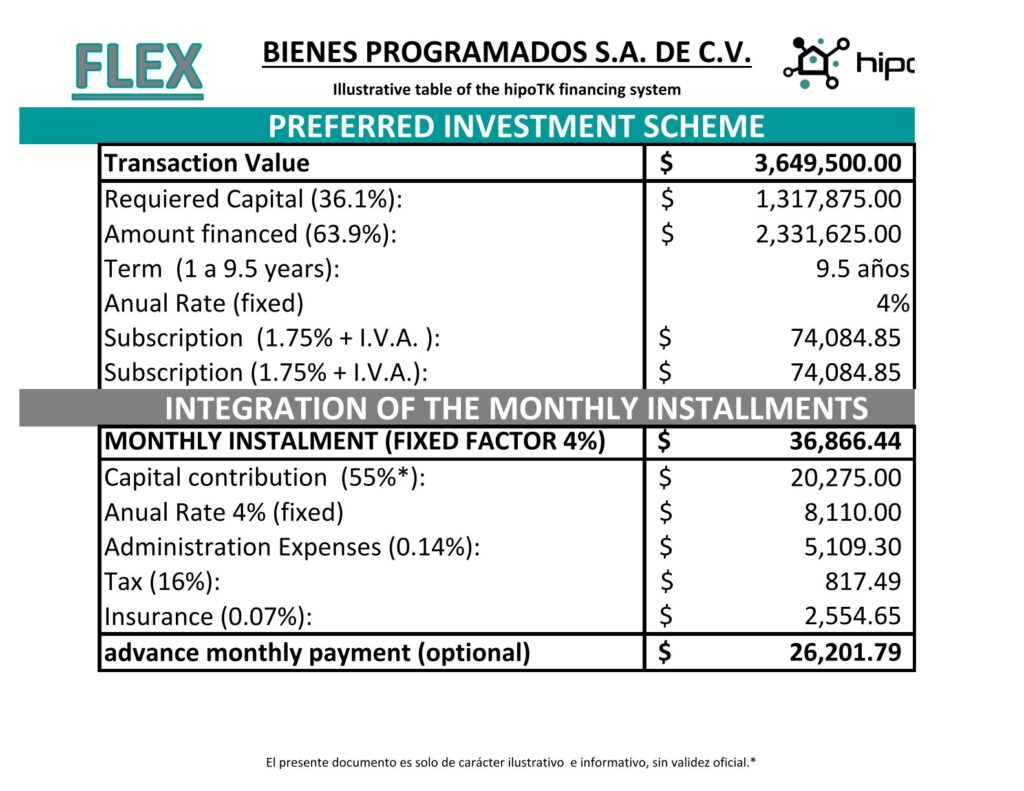

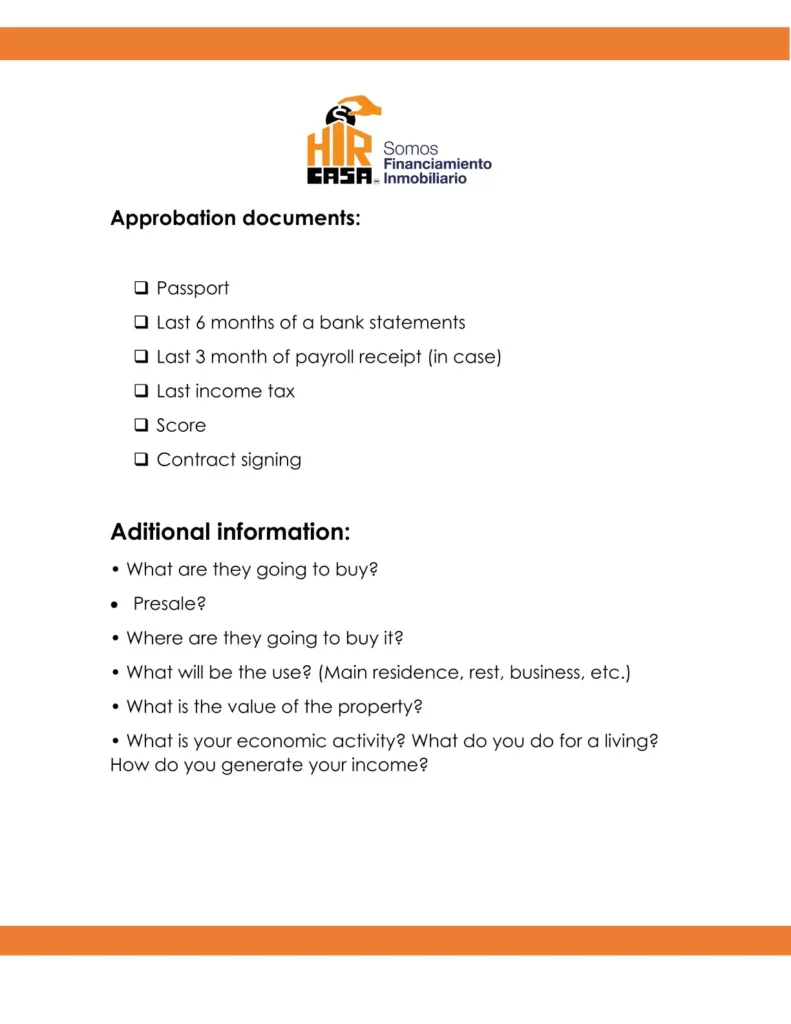

HIRCasa is a private lender with all the credentials and experience necessary to provide this type of loan. HIRCasa provides the best fixed interest rate of all options out there at a very low 4% fixed interest rate. The drawback is in that they require you them back within 9.5 years at a maximum. A short-term loan means that the monthly payments are higher. HIR Casa does provide cover 65% of the total value and this loan is especially for pre-construction. If this fits your need contact Sayuri from our financing page.

Lastly we have Creditaria with true mortgage brokers Thalia and Viviana. These brokers help you get the right type of loan via a bank or a private lender. For this example, they provided an attractive loan option that asks for only 30% of the total value and covers 70% In this option you can pay more down at a 10.5% interest rate. But, the monthly payments of $30,000 MXN per month, not so bad.

The drawback is the ever changing peso to usd exchange rate that you would have to deal with on a month-to-month basis. You would be required to make monthly payments in pesos since your credit was in pesos. In reality the drawback here could only improve since the interest rate now is at a low 16.75. This gives you the creative idea of paying the loan off when the peso goes up to save money.

Final thoughts on your options to buy a new condo in Mexico with mortgage

There are not many loan options for a property in the lower sales price. You most certainly have to save close to $75,000 USD to qualify for a loan. It is possible to find a new pre-construction condo that is at a 20 minute walk from the marina and the beach in Nuevo Vallarta, Nayarit.

You can very easily reserve the condo with 63k, wait about 5 months until the developer is closer to delivery, at that point you would pay CBI´s fee (3% + IVA taxes = $6,540). and a month or two from that at closing you would need to cover the rest of the money actually needed down to the developer ($87,200-63,000=$24,200) and cover the rest of the closing costs and fees (27,808-$6,540=$21,268). This loan would leave you a lower monthly payment…in USD. Or you can use a loan in pesos and pay back in pesos when the time is right for you.