Financing In Mexico Is Now An Option

Financing In Mexico Is Now An Option. At Jalisco Real Estate we want to help you find your finance your dream. We do this by connecting you with the financial experts. When you are approved get back to us to find the property you are looking for. 😁👌

Financing in Mexico

Owning a property in Mexico is a dream that can now be a reality. Property in Mexico is usually a second home, a home away from home.

Financing is available through a private lender in Mexico. Do not hesitate to contact the experts as interest rates have lowered to compete with rates in the U.S.

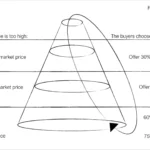

In most cases, you are only given up to 70% of the total value of the property you want. This means that you still have to come up with 30% of the total value.

Financing can be for up to 25 years to keep your monthly payments low. While other plans are shorter term of 10 years to help you pay faster.

Most lenders lend pesos and expect to be paid in pesos. This presents a problem due to the forever changing interest rates. The solution is to borrow USD and pay in USD. Make sure you ask if want this option.

Karina López

Jr. Mortgage Underwriter Director

If you are interested in more details please contact us or one of these lending brokers directly.

A lending broker is a professional who acts as an intermediary between borrowers and lenders. Their role is to connect individuals or businesses seeking loans with financial institutions or lenders who are willing to provide the desired financing. Lending brokers have expertise in various loan products and can help borrowers navigate the lending process, compare different options, and find the most suitable loan terms for their specific needs. They gather the necessary financial information from borrowers, including credit history and income details, and use that information to match them with potential lenders. Lending brokers can save borrowers time and effort by streamlining the loan application process and negotiating favorable terms on their behalf.